For the purposes of this publication, a non-insurance entity should be considered as any entity whose primary source of business is not the issuance of insurance contracts as defined in IFRS 17, and whose contractual activities are not actively monitored by an insurance regulator. In many jurisdictions there are laws and regulations that define whether or not the activities of a reporting entity result in it being classified as an insurer or not.

Introduction

IFRS 17 does not constitute industry specific guidance. Instead it specifies principles which should be applied to contracts that meet the definition of an insurance contract in IFRS 17 irrespective of the legal and regulatory status of their issuer.

Therefore, entities issuing extended warranties, credit related guarantees, guarantees of pension obligations of Group entities, bonds related to participation in tenders or for contract execution, weather derivatives, etc. should carefully analyse the terms of such arrangements even when they do not have the legal form of an insurance contract.

The significance of IFRS 17’s scope for non-insurance entities

IFRS 17’s definition of an insurance contract and its scope have not changed significantly from what was set out in IFRS 4, which might lead non-insurance entities into thinking they need not concern themselves with this Standard.

IFRS 4 had allowed entities issuing insurance contracts to carry on accounting for them using policies that had been developed under their previous local accounting standards. This meant that entities have continued to use a multitude of different approaches for accounting for insurance contracts, making it difficult for the users of financial statements to compare and contrast the financial performance of similar reporting entities.

This is not the case under IFRS 17, which goes much further to solve the comparative problems created by IFRS 4 by requiring all insurance contracts to be accounted for in a consistent manner. Specifically, the Standard requires entities to use a current measurement model for their insurance liabilities, using updated information for risks and obligations. As with all principles-based standards, there are still differences in methods that may be applied, such as determining discount rates or risk adjustments. However this is still a significant improvement over the requirements of IFRS 4.

Non-insurance entities that had previously applied IFRS 4 were able to apply their existing accounting policies to insurance contracts that fell within the scope of that Standard. However when applying IFRS 17 they can only apply accounting policies that are permissible under IFRS 17 for any reporting period that begins on or after 1 January 2023.

Non-insurance entities need to be alert to the possibility that contracts they have issued (or may issue in the future) might now fall within the scope of the new Standard. This may result in some significant changes. We therefore recommend that they analyse their contracts using the following steps:

Download the full article 'IFRS 17 - Impact on non-insurance entities [ 227 kb ]' which takes you through these different considerations, alerting you to the factors that should be considered.

Where non-insurance entities conclude they have issued contracts within the scope of IFRS 17, they will need to consider the adequacy of their information systems, relevant processes, people and governance to satisfy considerably more complex recognition and measurement routines and demanding presentation and disclosure requirements set out in the Standard.

When does a contract meet IFRS 17’s definition?

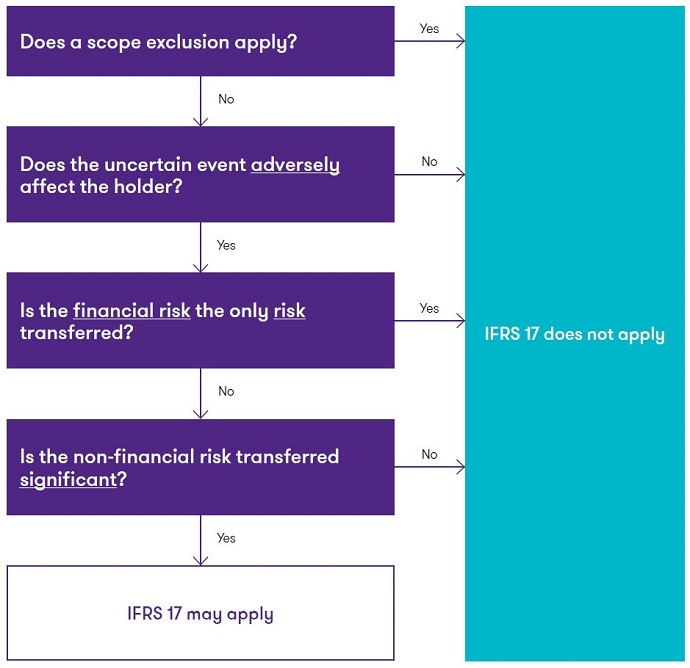

IFRS 17 defines an insurance contract in a similar way to IFRS 4 - A contract under which one party (the issuer) accepts significant insurance risk from another party (the policyholder) by agreeing to compensate the policyholder if a specified uncertain future event (the insured event) adversely affects the policyholder.

The definition is made up of several key features:

- The transfer of insurance risk, which is defined as ‘risk, other than financial risk, transferred from the holder of a contract to the issuer’

- The insurance risk transferred must also be significant

- Compensation under the contract is linked to the occurrence of the insured event

- The policyholder must already be exposed to the insurance risk, with the insured event having an adverse effect on the customer if it occurs.

Non-insurance entities then need to establish the existence and extent of any insurance risk transfer in order to correctly account for the contract under the appropriate IFRS.

Is the contract covered by IFRS 17’s scope exceptions?

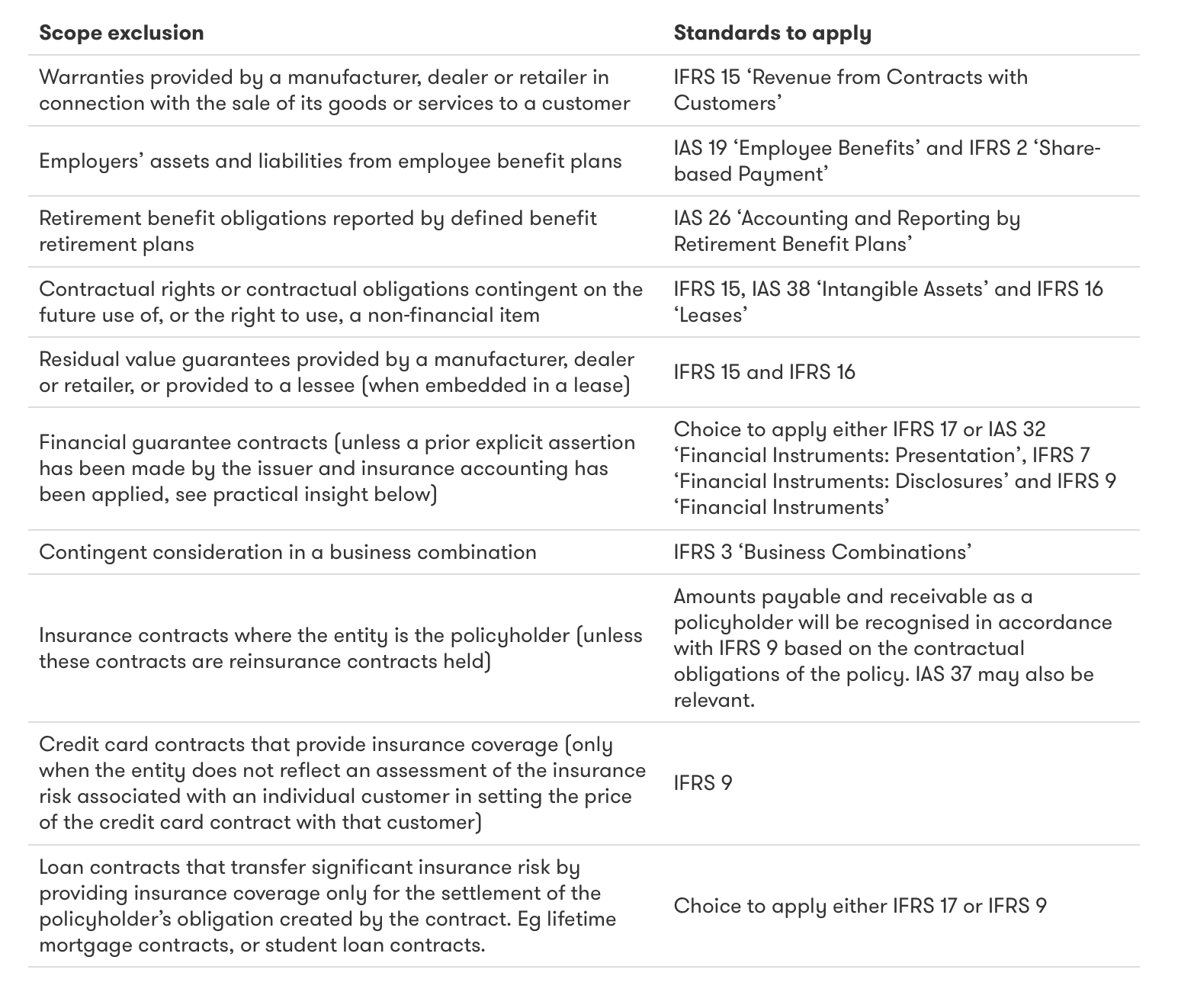

IFRS 17 includes a number of scope exceptions. This means many non-insurance entities may not have to apply IFRS 17 to the contracts they issue. But these scope exceptions need to be carefully considered because many of them may require a lot of judgement to be exercised.

Generally, the scope exclusions found in IFRS 17 are similar to those under IFRS 4 and they are summarised in the table below:

Where a contract falls into one of these scope exceptions, it should be accounted for under the appropriate alternative accounting standard as illustrated above. Note however, for financial guarantee contracts, an entity can choose to apply IFRS 17 if it so wishes.

A financial guarantee contract or an insurance contract?

A financial guarantee contract is defined by IFRS 9 as a contract that requires the issuer to make specified payments to reimburse the holder for a loss it incurs because a specified debtor fails to make payment when due in accordance with the original or modified terms of a debt instrument.

The definition, which is quite narrow, only applies where the guarantee relates to a debt instrument. It does not therefore capture product warranties, performance bonds and non-specific ‘comfort letters’ of the type sometimes issued by parent entities to subsidiaries.

Such contracts generally meet IFRS 17’s definition of an insurance contract and fall within the scope of the Standard. However, they are essentially a means of transferring credit risk and given this, many people believe they should be accounted for as financial instruments given they are economically similar to other credit-related contracts within the scope of IFRS 9.

Given this, the IASB decided to include such contracts in the scope of IFRS 9. However, if an issuer of financial guarantee contracts has previously asserted explicitly that it regards such contracts as insurance contracts and has used accounting that is applicable to insurance contracts, the issuer may elect to apply either IFRS 9 or IFRS 17 to such financial guarantee contracts. IFRS 9 permits an issuer to make that election on a contract by contract basis, but where such elections are made, the election for each contract is irrevocable.

Is the contract a fixed fee service contract?

Some contracts meet the definition of an insurance contract but their primary purpose is simply to provide services for a fixed fee, for example, road recovery contracts. Such contracts are within the scope of IFRS 17, however, an entity issuing such contracts may choose to apply IFRS 15 to them if, and only if, all of the following conditions are met:

- the entity does not reflect an assessment of the risk associated with an individual customer in setting the price of the contract with that customer

- the contract compensates customers by providing a service, rather than by making cash payments to the customer

- the insurance risk transferred by the contract arises primarily from the customer’s use of services rather than from uncertainty over the cost of those services.

The decision of which accounting standard to apply can be made on a contract by contract basis, but having made that choice for each contract, the accounting policy decision is irrevocable.

This policy choice is likely to be an important one for entities that, for example, enter into contacts to provide equipment maintenance or breakdown services for which the primary purpose is the provision of services.

Applying IFRS 17 when there are no scope exclusions

Where non-insurance entities conclude they have issued contracts within the scope of IFRS 17, then they will need to apply that Standard in full to those contracts.

IFRS 17 requires an entity that issues any insurance contracts to report them in their statement of financial position as the total of:

- the fulfilment cash flows – the current estimates of amounts the insurer expects to collect from premiums and pay out for claims, benefits and expenses, including an adjustment for the timing and financial risks related to those cash flows, and

- the contractual service margin – the expected profit for providing future insurance coverage (ie unearned profit).

Revenue recognised under IFRS 17 is significantly different to the recognition under IFRS 4, and likely different for any portion of contracts not accounted for under IFRS 4. Revenue is no longer linked to written premiums but instead reflects the change in the contract liability covered by consideration.

To better reflect changes in insurance obligations and risks, IFRS 17 requires an entity to update the fulfilment cash flows at each reporting date, using current estimates that are consistent with relevant market information. This means that insurance obligations will be accounted for using current values instead of historical cost, ending the practice of using data from when a policy was taken out.

Current discount rates are also required to be used. These will reflect the characteristics of the cash flows arising from the insurance contract liabilities, a change from the previous situation where many entities used discount rates based on the expected return on assets backing the insurance contract liabilities.

The Standard also includes extensive requirements relating to disclosure and the presentation of insurance performance. IFRS 17 includes multiple measurement models, and selecting the appropriate one depends on how a contract is classified. This article is focused on scoping considerations for non-insurer entities, more detailed information on recognition and measurement will be included in our future articles ‘Insights into IFRS 17 – Initial Recognition and Measurement’ and ‘Insights into IFRS 17 – Subsequent Measurement’.

Observations

Non-insurance entities who have not applied insurance accounting in the past are not necessarily exempt from applying insurance accounting in the future. The removal of the unbundling feature of IFRS 4 as well as the stricter measurement requirements set out in IFRS 17 may have a significant impact on the accounting of contracts that meet the definition of an insurance contract. Due to the complexity and time-consuming nature of applying IFRS 17, non-insurance entities (if they have not already done so), must pay careful attention to this Standard to ascertain whether it is applicable or not.